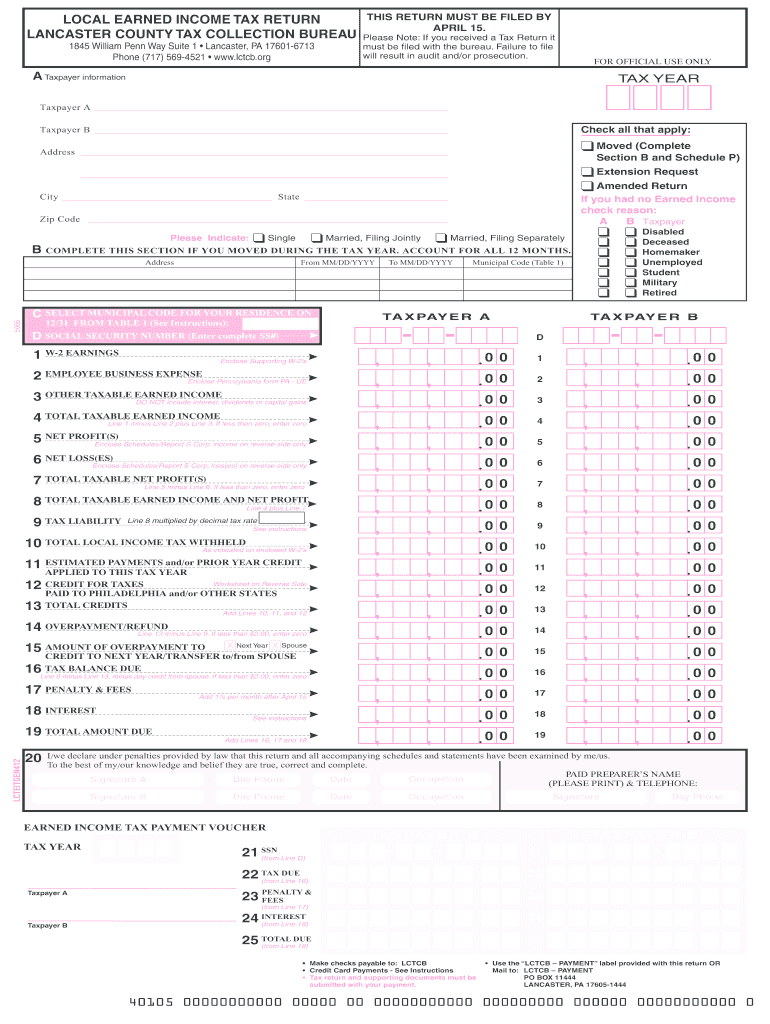

philadelphia transfer tax form

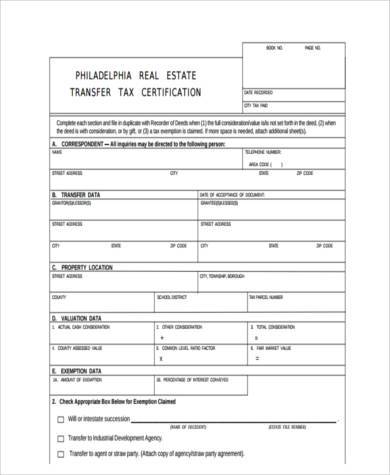

When you complete a sale or transfer of real estate that is located in Philadelphia you must file and pay the Realty Transfer Tax. Will or Intestate Succession A transfer by will for no or nominal consideration or under the intestate succession laws is exempt from tax.

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Is the deed transfer tax exempt.

. Ance on the Realty Transfer Statement of Value form. And estate file number in the space provided. Deed transfers and entity transfers have their own unique forms.

If there are any questions that a resident may have they can reach out to the Philadelphia Sheriffs. Transfer to a Trust A transfer for no or nominal consid-. The advanced tools of the editor will direct you through the editable PDF template.

If you dont have an account yet register. Forms include supplementary schedules worksheets going back to 2009. For more information regarding the real estate transfer tax please contact our law offices via our contact form or call 1800LAW-1914.

The city of Philadelphia has an 800 percent sales tax rate which is made up of 600 percent Pennsylvania state sales tax and 200 percent Philadelphia County sales tax. Download forms and instructions to use when filing City tax returns. REV-1728 -- Realty Transfer Tax Declaration of Acquisition.

PA Realty Transfer Tax and New Home Construction. The fee for a deed transfer in Philadelphia is 700. Philadelphia Beverage Tax PBT Understand the PBT notification-confirmation process.

This link will take you to a sales tax table with an 800. 3278 City 1 Commonwealth 4278 Total The tax rate is based on the sale price or assessed value of the property plus any assumed debt. See all Tax forms.

Nominal consideration or under the intestate succession. Philadelphia Code 19-1405 6 exempts transfers between. Regulations rulings tax policy.

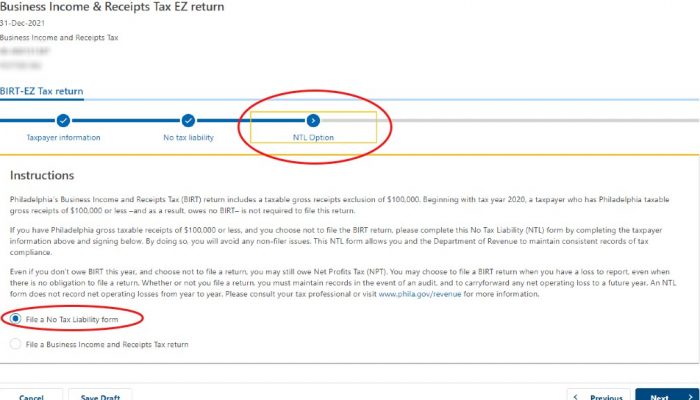

Business Income Receipts Tax BIRT regulations. Enter the name address and telephone number of party completing this form. It pays to have a professional involved.

Complete the correct certificate and submit it when you record the deed or mail in your Realty Transfer Tax. Enter the date on which the deed or. Real estate transfer tax in Philadelphia can get dicey.

Enter the date on which the deed or. Sign Online button or tick the preview image of the blank. The way to complete the Philadelphia form transfer taxsignNowcom 2011-2019 online.

Download Donors Tax Return. A divorced couple pursuant to the divorce decree Parent and child or the childs spouse Brother or sister or their spouse Grandparent and grandchild or the. Enter the name address and telephone number of party completing this form.

Get philadelphia transfer tax form signed right from your smartphone using these six tips. This return shall be filed in triplicate by any person natural or juridical resident or non-resident who transfers or causes to transfer property by gift whether in trust or otherwise whether the gift is direct or indirect and whether the preoperty is real or personal tangible or intangible. Get the free philadelphia realty transfer tax form 2011-2022 Get Form Show details Hide details A statewide list of the factors is available at the Recorder of Deeds office in each county.

Talk with a real estate lawyer from High Swartz to be safe. This property is exempt from any relevant local or special taxations. 2021 Net Profits Tax NPT forms.

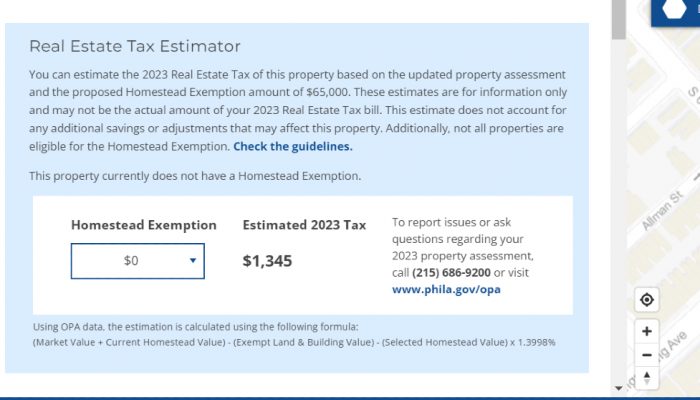

2021 Business Income Receipts Tax BIRT forms. If no sales price exists the tax is calculated using a formula based on the property value determined by the Office of Property Assessment OPA. REV-715 -- Realty Transfer Tax Monthly Report.

How is PA transfer tax calculated. The county determines the recording fee and we add an administrative fee on top of that. Real Estate Transfer Tax certificates.

How is Philadelphia transfer tax calculated. 2 percent X 100000 2000 in Pennsylvania. REV-183 -- Realty Transfer Tax Statement of Value.

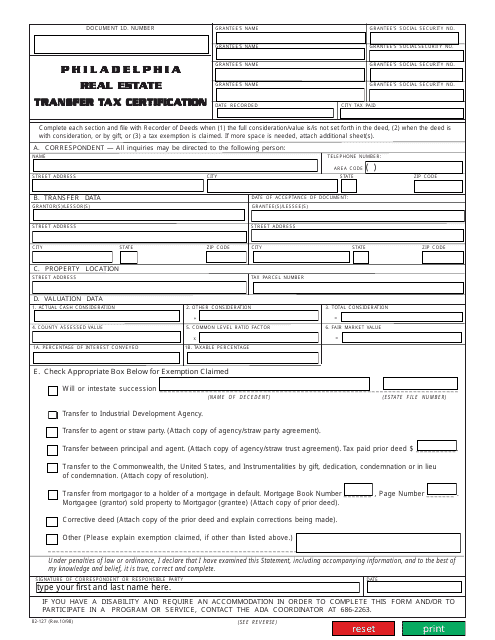

To begin the form utilize the Fill camp. Instructions for completing philadelphia real estate transfer tax certification Section A Correspondent. The state of Pennsylvania charges one percent of the sales price while the municipality and school district each charge one percent of the sales price for a total of two percent ie.

2 x 100000 2000. Fill Sign Philadelphia Form Transfer Tax 1993. Consider the transfer tax sometimes known as a tax stamp to be a type of sales tax on real estate.

Instructions for completing philadelphia real estate transfer tax certification Section A Correspondent. Section B Transfer Data. One of the most popular transfer tax exemptions is the intra-family exemption.

Provide the name of the decedent and estate file number in the space provided. The Guide of finalizing Philadelphia Real Estate Transfer Tax Certification - City Of Philadelphia Online. Enter your official identification and contact details.

Look up your property tax balance. The state realty transfer tax is 1 of the total computed value. Enter the name address and telephone number of party completing this form.

REV-1651 -- Application for Refund PA Realty Transfer Tax. For counties ranging from Erie Elk Franklin and Centre through Bucks Berks and Butler the fee for a deed transfer is 700 with the exception of Philadelphia which charges 750. 2021 School Income Tax forms.

The current rates for the Realty Transfer Tax are. Life Estate Remainder Chart -- Life Estate Remainder Chart. 2 x 100000 2000.

Husband and wife. Section B Transfer Data. The Sheriffs Office will also continue to host food giveaways and virtual town halls to answer any questions that residents may have.

Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278.

Philadelphia County Quit Claim Deed Form Pennsylvania Deeds Com

How To Get A Property Deed In Philadelphia

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Free 10 Sample Real Estate Tax Forms In Pdf Excel

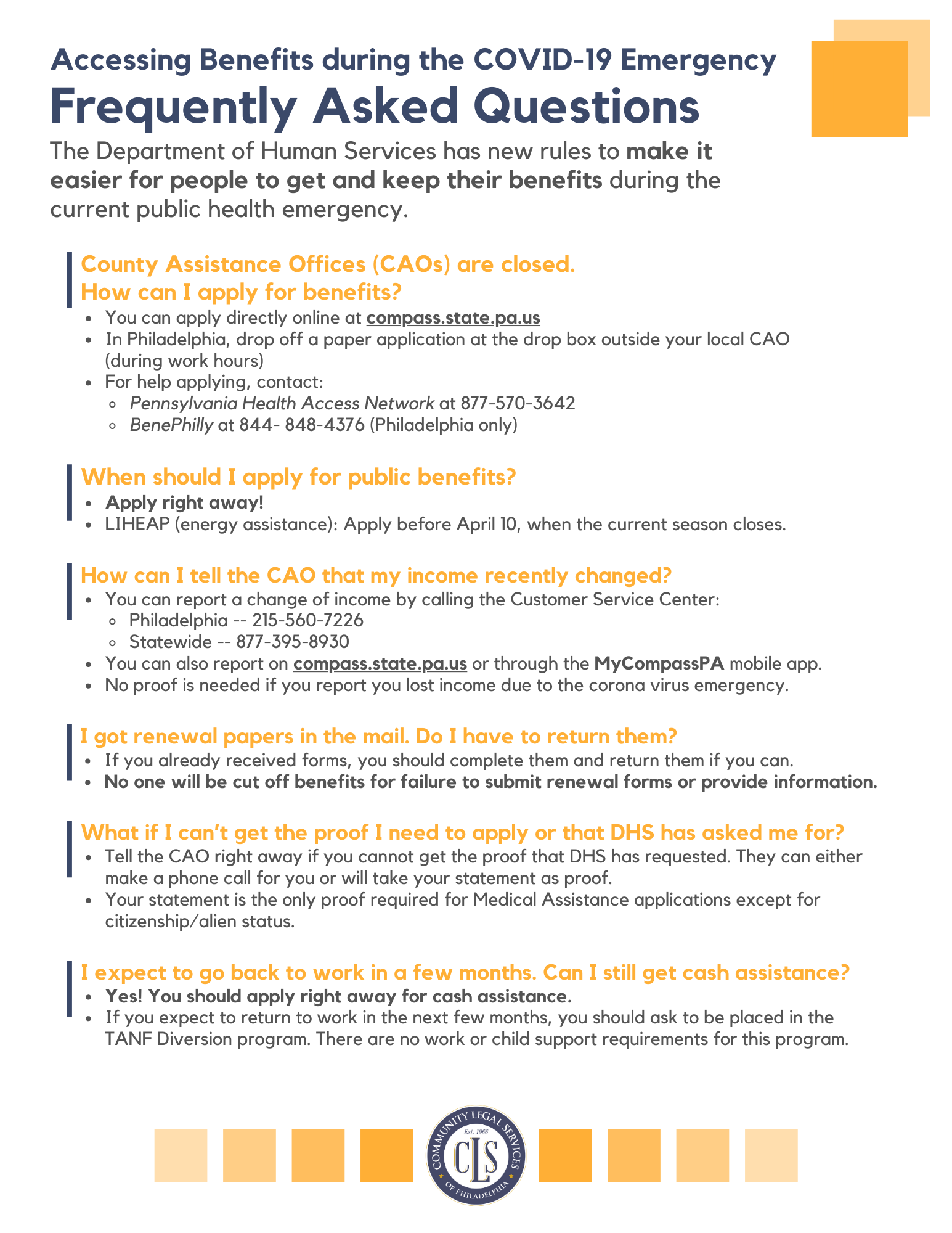

Coronavirus Bulletin Board Aids Law Project

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Money Orders How To Track Some Of The Most Popular Money Orders Savingadvice Com Blog Fake Money Money Template Ways To Get Money

Philadelphia County Gift Deed Form Pennsylvania Deeds Com

Form 82 127 Download Fillable Pdf Or Fill Online Real Estate Transfer Tax Certification City Of Philadelphia Pennsylvania Templateroller

Philadelphia Eagles Bra New For 2015 Etsy Philadelphia Eagles Rave Outfits Places To Visit

Form 82 127 Download Fillable Pdf Or Fill Online Real Estate Transfer Tax Certification City Of Philadelphia Pennsylvania Templateroller

Philadelphia Launches New City Tax Site Brinker Simpson

Pennsylvania Quit Claim Deed Form Quites The Deed Nevada

Four Philadelphia Taxes Due On April 18 Department Of Revenue City Of Philadelphia

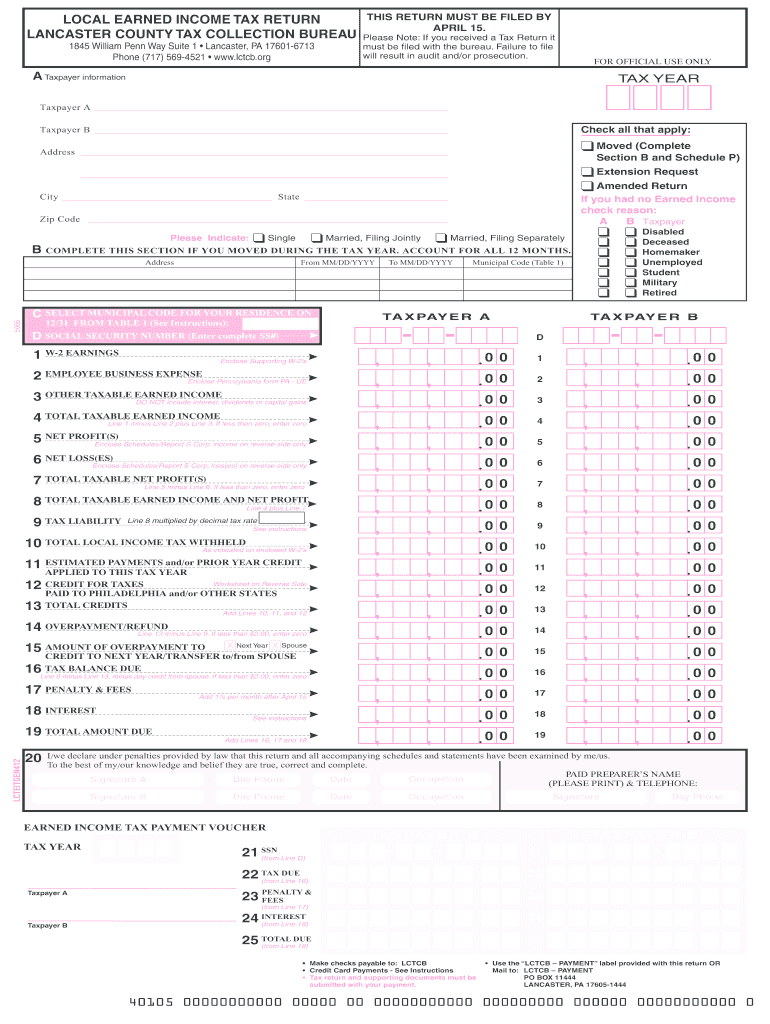

Pa Local Earned Income Tax Return Fill Out Tax Template Online Us Legal Forms

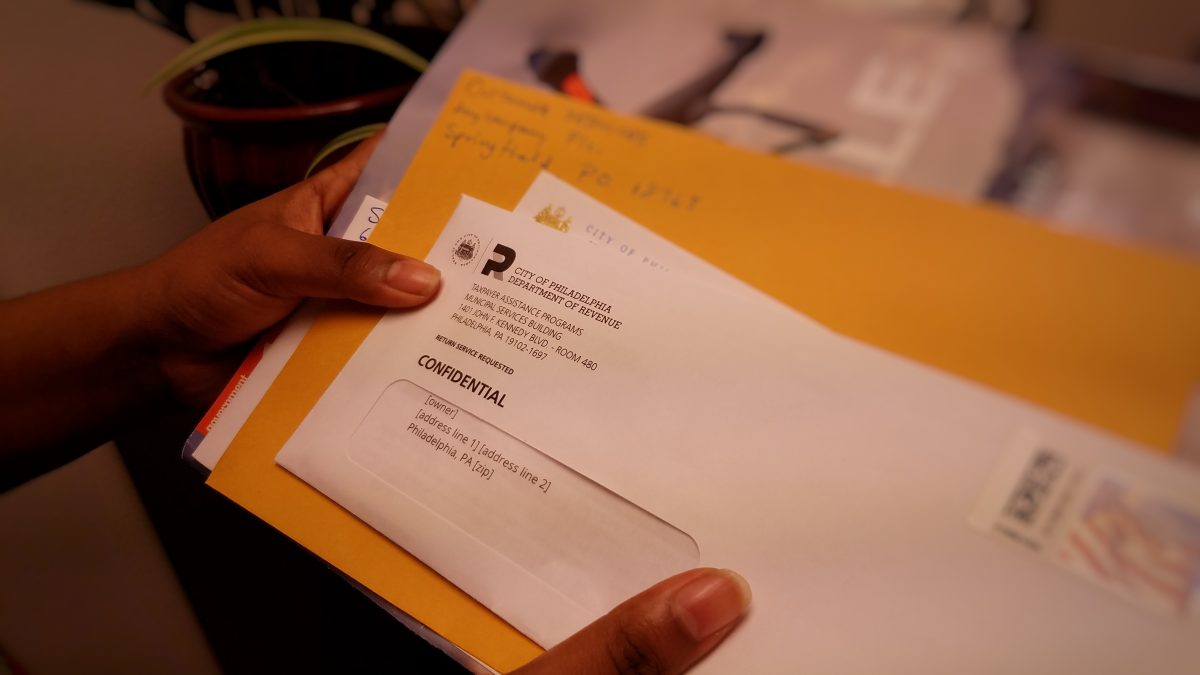

Check The Po Box Mailing Tax Payments Forms To Revenue Department Of Revenue City Of Philadelphia

Deed Fees In Philadelphia County Pennsylvania

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

Four Philadelphia Taxes Due On April 18 Department Of Revenue City Of Philadelphia